forum

library

tutorial

contact

Renewable NW Responds to

LSRD Power Replacement Study

by Sashwat Roy

Clearing Up, July 22, 2022

|

the film forum library tutorial contact |

|

Renewable NW Responds to

by Sashwat Roy

|

Idaho Power's recent portfolio modeling in its 2021 IRP shows that

ELCC values of hybrids and four-hour stand-alone storage exceed 85%

BPA's study of optimal capacity expansion scenarios with and without the lower Snake River dams indicates a disregard for existing renewable and storage capacity resources vital to ensuring resource adequacy in the region, according to Renewable Northwest's analysis.

BPA's study of optimal capacity expansion scenarios with and without the lower Snake River dams indicates a disregard for existing renewable and storage capacity resources vital to ensuring resource adequacy in the region, according to Renewable Northwest's analysis.

The Energy and Environmental Economics study portrays an alternate reality where only "firm or dispatchable" resources like natural gas-fired power plants and small modular nuclear reactors are able to replace the capacity provided by the LSRD. Hybrid and standalone storage projects (including long-duration storage resources) in conjunction with distributed energy resources and demand response mechanisms will be important complementary resources to BPA's hydro fleet in providing the necessary capacity and flexibility to the Pacific Northwest electric grid.

The modeling tool used, RESOLVE, does not account for the full value of hybrid and stand-alone storage resources. Rather than make decisions based on a one-year model, the RESOLVE model simulates the operations of WECC's system for 41 independent days sampled from the historical meteorological record from 2007-2009.

It is risky to assume that this abbreviated time series accurately captures the full intrayear variability of renewable resources and storage as well as that of the hydro system. Studies comparing different generation types typically rely on production-cost models that can run sequentially for 8,760 hours and can fully dispatch resources across hours, days and weeks to understand the system and resource interactions, and dispatch. Instead, RESOLVE selects resources based primarily on their capital costs and capacity accreditation value to fill the need.

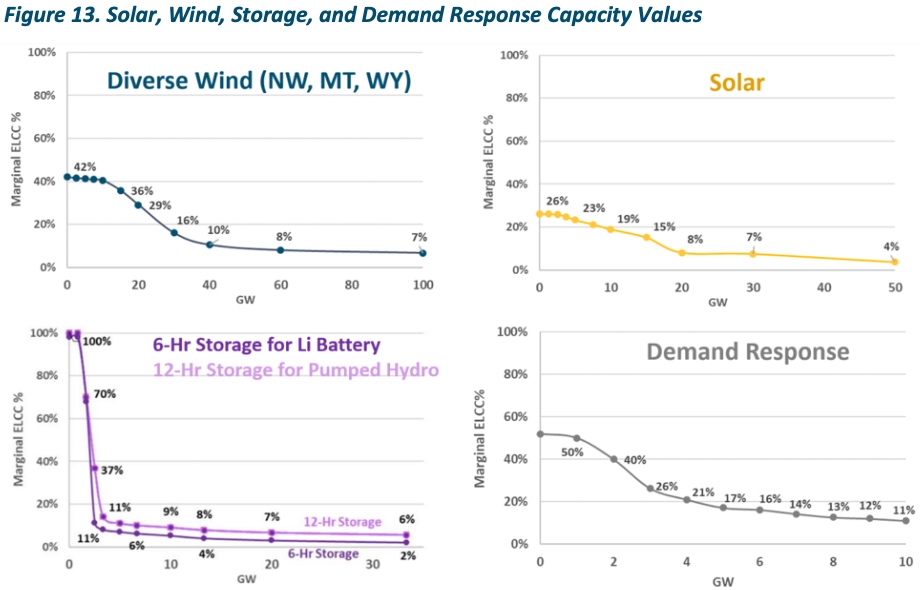

RESOLVE replaces the energy from the dams with additional wind power and "firm capacity" with natural gas and hydrogen combustion plants. Small amounts of energy efficiency and battery storage are also selected in some scenarios. The report mentions that "storage resources such as battery storage and pumped hydro support renewable integration but show limited capacity value given the large shares of hydro in the Northwest region."

This highlights the limitations of relying on a capacity expansion model without a full-year production-cost model because storage resources can provide both flexibility and capacity benefits and act as a complement to hydro resources.

The report does not mention hybrid solar/wind plus battery storage resources at all. Although battery storage resources can be selected individually by the RESOLVE or RECAP model, the model cannot co-optimize its dispatch with solar or wind generation. The cost-effectiveness of hybrid resources in the region is shown in recent integrated resource plans from PacifiCorp, Portland General Electric and Idaho Power, where hybrid resources -- especially solar paired with four-hour battery storage -- have over 80 percent effective load carrying capability (ELCC) value.

Idaho Power's recent portfolio modeling in its 2021 IRP shows that ELCC values of hybrids and four-hour stand-alone storage exceed 85 percent with eight-hour battery storage assigned a 97 percent ELCC value. It is implausible that a capacity expansion model would not select solar plus storage or even long-duration stand-alone storage resources like pumped hydro in the region unless the model does not fully realize their value. If the model cannot endogenously co-optimize, it leads to overbuilding and over-curtailment in the resource portfolio.

E3's modeling does not account for the impact of climate change-adjusted hydro and load in the changing demand pattern of the region. According to the recent 2021 Secure Water Act Study by the Bureau of Reclamation, increasing temperatures, earlier runoff and lower summer flows may reduce hydropower flexibility in the Pacific Northwest.

This is particularly impactful for the summer peak hours. E3 states that "[t]he biggest cost drivers for replacement resources are the need to replace the lost firm capacity for regional resource adequacy" especially during multiday events in the winter. The climate data suggests that the Pacific Northwest is increasingly moving toward more high-demand hours in the summer than winter due to lesser hydro availability in summer primarily due to higher temperatures. This was also the conclusion of the Northwest Power and Conservation Council's 2021 regional plan. It is surprising that E3 does not consider downscaled climate data that BPA has worked on to undertake this regional analysis and instead relies on outdated historical data for future projections.

The region is moving toward clean, non-emitting capacity resources to meet capacity needs and state-policy targets. Investor-owned utilities like PacifiCorp, PGE, and Idaho Power will procure more than 3 GW of solar, wind, hybrid and energy storage resources over the next few years because of their zero variable costs, increasingly lower capital expenditures, and operational characteristics that include flexibility and dispatchability.

The E3 study selects extremely speculative near-term resources, dual-fuel natural gas and small modular reactors, to replace the LSRD. The Oregon PUC recently acknowledged PacifiCorp's 2021 IRP only to the extent that nuclear is not included in the preferred portfolio, which indicates the financial risk in such investments (CU No. 2049 [10]).

The E3 study selects extremely speculative near-term resources, dual-fuel natural gas and small modular reactors, to replace the LSRD. The Oregon PUC recently acknowledged PacifiCorp's 2021 IRP only to the extent that nuclear is not included in the preferred portfolio, which indicates the financial risk in such investments (CU No. 2049 [10]).

While hydrogen-fired combustion turbines may be cost-effective in the future, there is not enough supply or infrastructure in the region to satisfy that need in the near term.

Additionally, the study does not consider the electrolyzer load that would be added to the system and how it would interact with the generation portfolio in the Pacific Northwest. Investing in natural gas-fired generation plants in the present with a hope that eventually they would be converted to burn hydrogen is a risky investment strategy.

The effect of the Western Resource Adequacy Program is not captured in the E3 study. E3 states that "resource adequacy needs are captured in RESOLVE by ensuring that all resource portfolios have enough capacity to meet the peak Core Northwest median peak demand plus a 15 percent planning reserve margin."

Once WRAP is up and running, the load and resource diversity in the region will lead to a more efficient resource buildout and allocation going forward, lowering planning reserve margins for individual utilities. It is unclear why E3 uses data that is inconsistent with WRAP's assumptions for reduced PRM.

To meet regional decarbonization goals and mandates irrespective of whether the lower Snake River dams are breached or not, load-serving entities will need to procure clean and non-emitting capacity resources like solar or wind, paired with battery storage and longer duration batteries and pumped-hydro resources.

Investor-owned utilities in the region have already started on this energy transition. It is unhelpful to the region to continue to rely on speculative markets and outdated modeling assumptions which exclude existing capacity resources. The tools and analysis used to determine how to move forward on new procurements and generator replacements need to consider resources which are commercially available and consistent with our region's procurement mandates and decarbonization goals.

Steve Wright wrote in last week's column that the region is taking a risk by waiting for a "mystery resource" to rescue us from our resource adequacy issues.

In fact, there is also an argument that there is no mystery resource at all but a portfolio of resources, each having their own values, that would be able to solve these challenges.

Perhaps the mystery resource is staring us right in the face and we just need to look differently at the resources we currently have at our disposal.

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum