forum

library

tutorial

contact

Meeting California's Needs

with Out-of-State Hydro

by Randy Hardy

HydroWorld, June 25, 2018

|

the film forum library tutorial contact |

|

Meeting California's Needs

by Randy Hardy

|

We're probably looking at 10 to 15 years of power prices below $30.

At a Northwest Power and Conservation Council meeting in November 2017, Randy Hardy spoke about electricity generation markets in the U.S. state of California. Hardy is a former administrator of the Bonneville Power Administration (which markets the power produced by federally-owned hydro projects in the Pacific Northwest of the U.S.) and also was the chief executive officer of Seattle City Light. During that talk, he discussed the state's 50% renewable portfolio standard and how hydropower can help with the energy situation. Below are some excerpts.

I want to talk about the California energy business and how that might affect the Pacific Northwest and Western Electricity Coordinating Council (WECC). California is probably 40% to 50% of the total WECC load, so it will have major ramifications for what happens in the Northwest.

I want to talk about the California energy business and how that might affect the Pacific Northwest and Western Electricity Coordinating Council (WECC). California is probably 40% to 50% of the total WECC load, so it will have major ramifications for what happens in the Northwest.

California passed, in 2011, a 50% renewable portfolio standard by 2030. Three investor-owned utilities are at 30% to 35% of their power supply from renewables. That's the framework within which decisions are being made. The reality is that all the possible wind capacity has been acquired. The other California wind sites are transmission constrained. So the only renewable resource to get to 50% is solar. And there's already a dramatic solar surplus.

That's just procurement of utility-scale solar. Rooftop solar is growing faster than utility solar. California has the most generous net metering policies in the U.S. The tax incentives -- state and local -- and the fact that you get the retail rate from the investor-owned utility when you sell it back to them, make installation of rooftop solar extremely attractive.

So you have flat or declining load growth in California. And you're growing solar at 2 GW per year. One consequence for WECC is that, if you continue to enlarge the solar surplus and fracking keeps natural gas prices low, we're probably looking at 10 to 15 years of power prices below $30. You're going to have this enormous surplus that will force wholesale prices quite low, ironically, while retail rates go up, because all the solar costs you have with RPSs continue to flow through to retail rates.

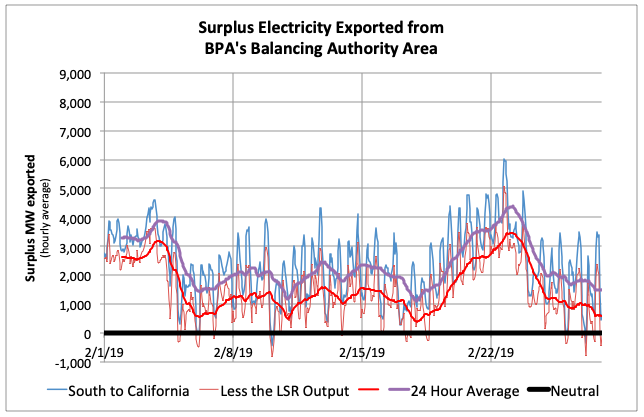

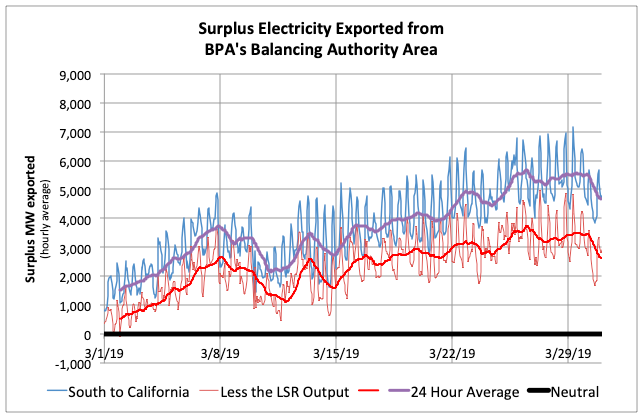

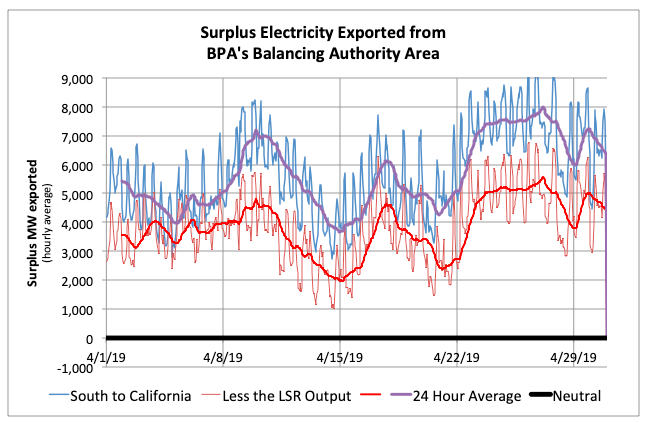

It's already had significant implications for BPA and the region's hydro-based utilities because they've lost an enormous amount of their traditional secondary hydro sales. The combination of low gas prices and the solar surplus has severely reduced spring hydro surplus sales. So you're spilling more, and what you are selling, you're not getting the prices you historically obtained. That creates considerable upward rate pressure.

The California solar surplus creates two problems:

The California solar surplus creates two problems:

There is no more traditional heavy load hour/light load hour paradigm. The low net load time in California is now 2 p.m. The peak load tends to be in the evening, when the sun goes down. So you have an ever-growing midday solar surplus. In the spring, loads are at their lowest, because you're not yet running air conditioners and you don't need heating.

Last April and May there was significant negative pricing and curtailments. Negative pricing means you pay the buyer to buy it. With a tax credit and renewable energy credits, it makes sense to pay up to about $20 per MWh and still run the plant. But you're going to have increased negative pricing. Each investor-owned utility has a supply curve. They'll pay up to a certain point, depending on the power purchase agreement with each solar provider, and then they'll curtail when it is no longer economic to do that. What you'll have is increasingly massive curtailments, eventually year-round.

If you can imagine this, somewhere in the 2020 to 2022 timeframe, California will reach a no-net-load proposition. What will we do in those circumstances? You can solve that up to a point with massive solar curtailments, and that's probably what is going to increasingly occur. And what the California Independent System Operator is worried about is that at some point it will produce a political reaction.

One of the political dynamics in California is that you have, particularly in the state legislature, officials who voted for this 50% RPS and are reluctant to acknowledge it has significant problems. This is kind of that classic line from Ronald Reagan in the 80s: "If there is no solution, there is no problem." That complicates the dynamic of trying to find a solution.

In CAISO's flex capacity stack, 40% of those so-called flexible resources are long-start resources. You have to fire them up the day before to meet a five-minute increment the next day. To put it mildly, the CPUC resource acquisition priorities are completely misaligned with CAISO's needs. Yet, you can't change that without the CPUC and CAISO and California Energy Commission (the agency that approves sites for new resources) changing their procurement priorities.

The dynamic this is creating is that the CPUC is distracted by trying to figure out how it regulates these aggregators and not paying much attention to operational issues. And the California investor-owned utilities are worried they're going to lose a bunch of load. They don't want any extra costs that could become stranded costs. They don't want to change the resource procurement priorities and be required by the CPUC to acquire new, fast-acting gas resources to help meet the ramp. They just want status quo until this penetration of Community Choice Aggregators can be sorted out.

To give you an example, Pacific Gas & Electric thinks that in five years, they may lose half of their load. PG&E is the largest utility in the country. That's an amazing phenomenon.

Back to my comment that if there is no solution, there is no problem, elements in the legislature deny there is a problem. They say the duck curve you've heard about -- that the belly of the duck is when the solar surplus occurs in midday -- is just a hoax.

Then, you have the California labor interests, who don't want to acknowledge the problem. And they don't want to procure out-of-state resources. They want an all-solar path to 50% and they want it all to be in state so they can generate as many jobs as possible. They have a stranglehold on the California State Legislature. Who knows where all these conflicting trends will lead?

One pretty straightforward solution would be to access Pacific Northwest hydro. Hydro is by far the most flexible resource you can use. All you do is open a wicket gate. And CAISO's problems with the evening ramp are not just a three-hour problem but a within-hour problem. The ramp at its maximum is 15,000 MW. But it's growing, because you're adding 2,000 MW of solar each year. A single hour of the three-hour ramp is often more than 50% of the entire three-hour ramp. A single, 15-minute period of each hour is often more than 50% of the hourly ramp. A single, five-minute period of the 15-minute ramp is often more than 50% of the 15-minute ramp. So you've got not only a three-hour exponential ramp, you have a variability of several thousand megawatts within each hour and even within each 15-minute and, to some extent, each five-minute period.

CAISO took the first step to address the ramp issue in November 2017. They have in their 2018 catalog an initiative to look at a day ahead, 15-minute market capacity product. They'll develop this during 2018 and presumably put it into effect in 2019. That's the first time CAISO will be paying for capacity in its 20-year history. That's a step in the right direction. You have a capacity payment that gives Northwest hydro providers more time and more assurance that they can get the financial returns they need to sell. It doesn't make a lot of difference in Q2 or Q3 but it makes a big difference in Q4 and Q1, where you essentially face discretionary decisions of do I sell or do I store? If BPA, Powerex and Seattle City Light can get a capacity payment, chances are they can bid into the day-ahead market to do that.

Ultimately, you have to change your resource adequacy policies to procure more flexible resources, some of which could be hydro. Chelan County Public Utility District did a study that said if you substituted 1,500 MW of Northwest hydro instead of California thermal to meet the evening ramp, you would save about a half-million tons of CO2 per year. But again, there's political opposition to that, and it requires, at least in some circumstances, multiagency approval.

What will those circumstances produce for the Northwest? Continued, low power prices. BPA is well above market at a basic wholesale rate of $35. The raw long-term Mid-C price is probably $25, but that doesn't include transmission or reserves. The fully delivered price is more like $30 for a "market purchase" versus $35 for BPA's rate. And BPA's rate is going to continue to creep up. Fortunately, BPA has take-or-pay contracts, which don't expire until 2027.

I lived through the last crisis, where we had the same problem, albeit a much more temporary one. We woke up one day in April 1995, after deregulation, and our wholesale rate was $28, and Enron was offering five-year contracts to our public and aluminum company customers at $15 to $17. Fortunately, we were able to stabilize that and avoid missing a Treasury payment. In the process, we amended all of our contracts to make them take-or-pay.

Elliot Mainzer, administrator of BPA, has stability in the near term. But he needs to think that, if low power prices are going to continue, do I start to take steps now, anticipating that come 2027, I'm going to have some pretty dramatic diversification? You have two choices: One is to wait two to three years to see if the California market develops sufficiently, where you can sell big quantities of hydro capacity and other products to get the revenue return you need to make up for some of the losses you've incurred and keep your rates in check. Or, do you do long-term deals now if you have "surplus power" you can sell to one of the Northwest investor-owned utilities or maybe one of the marketers.

These are some interesting strategic choices the agency will face in the next five years.

These are some interesting strategic choices the agency will face in the next five years.

You also have numerous operational choices. By 2020, you'll have daily reversals of flow on the intertie. That hasn't happened since the early 1990s, when we did seasonal exchanges. That's one of the main reasons the Pacific Intertie was built, to dispose of the spring runoff hydro surplus and do seasonal exchanges, to take advantage of the seasonal diversity between California and the Northwest. You send power south in the summer to help run California air conditioners, and you get back electricity in the winter for heating. You'll have the same thing happening here, except it will be daily instead of seasonally. You'll send power south in the evening to help with the evening ramp, and it will come back the next midday. It's not happening now because the solar surplus is not yet severe enough. In addition, California has a $10 export fee. That will have to go. Because when you have negative prices, all you're doing is taxing your own consumers another $10/MWh.

What are the solutions going forward?

In mid-October 2017, CAISO put out a whitepaper that gives a good view of what's going on in California. It identifies general industry trends, not unique to California: More decentralized power procurement, less use of gas, more penetration of renewables, etc. Then there are proposed solutions. It's a fascinating mix of detailed and practical things that can be done, like acquire more flexible capacity and access out-of-state resources. So you can procure Wyoming wind or Northwest wind that has a load shape typically generating in the evening and the winter that compliments California solar load shape in ways that get you to 50%, but minimizes the cost and doesn't exacerbate the solar problem. That's prevented by other California legislation. And regionalization: expand CAISO to be a regional ISO, if you will. Again, that would help significantly, but there are governance challenges in the way of that.

Then it has another set of solutions I would charitably call aspirational that are more problematic. There is a heavy reliance on utility-scale storage. That's coming, but in the next five years, I don't think so. With a wind resource, if you get viable utility-scale storage for two to three hours, you can turn a 30% capacity factor wind plant into 70% to 80% capacity. With solar you need something overnight. You need 12 to 14 hours … we're 10 years away from that. You do have viable storage, or will have shortly, at the residential level.

Additionally, you have an assumption that you'll have 4 million electric vehicles on the street by 2030 in California. I think the current figure is 300,000. That will really help. In addition, you'll have the ability to precisely control when they charge and don't charge. That's a degree of control that's pretty unique, even for California. It's a social experiment that will be interesting to watch.

A more realistic set of measures would probably be, if the problem gets bad enough, you could increase your access to Northwest and other resources fairly dramatically. You have an energy imbalance market that's functioning pretty well right now, but that's only a five-minute market. One reason California is going to look at a 15-minute market day-ahead capacity product is because to transact in the five-minute market, you need dynamic transfer capability on the Intertie. There's only 400 MW of dynamic transfer capability on the AC Intertie. It might go to 600 MW. If you go to the 15-minute market, you have the full 4,800 MW of AC Intertie you can use. Probably in a couple of years, BPA will change its practices to get 15-minute scheduling on the DC, so the full 7,900 MW of both the AC and DC Interties will be available to the 15-minute market. Those are solutions. If you get rid of the export fee, if you rely more heavily on hourly and 15-minute market transactions out of state, and if you get rid of the legislative restrictions that effectively prevent much renewable importation from out of state, you'd go a long way toward solving both the midday solar surplus and evening ramp problems.

That's not something that requires a regional ISO. That could be done tomorrow. The impediments are California's own regulatory restrictions.

This industry is in the midst of enormous technological change. One vignette unrelated to California illustrates that best. Seattle has, by almost every account, the most commercial construction downtown of any city in the U.S. Commercial load is 40% of Seattle City Light's total load. And it's growing. Yet, overall Seattle City Light's loads are going down. This load decrease is driven by greatly increased penetration of LED lights and more sophisticated heating, ventilation and air conditioning systems in the commercial sector.

There are interim solutions that will help. Currently, they're largely precluded by politics in California. But as the problem gets worse, and the renewable curtailments get more pronounced, I think that will change.

You also have a significant chance of a major reliability event in California in the next five years. If that happens, that will change things in a hurry. The problem is, when that occurs, people will be far more interested in finger pointing than they are in solutions. It provides a motivation, but what solution comes out of that is anyone's guess. Having lived through one of those, I don't wish that on anybody. But there are significant risks that it could happen again.

learn more on topics covered in the film

see the video

read the script

learn the songs

discussion forum