Columbia River System Operations

Comment & Response

of bluefish.org

Cover Letter

----------------------------

Conservation

Coal

Carbon Sequestration

----------------------------

Irrigation

Barging Wheat

Barging Salmon and Steelhead

----------------------------

Survival of Salmon and Steelhead

Juvenile Survival through Hydrosystem

Water Temperature

Predation by Birds

Ocean Conditions

----------------------------

Greenhouse Gases

An Adequate Power Supply

An Economic Power Supply

A Reliable Power Supply

An Efficient Power Supply

----------------------------

Potatoes, Apples & Grapes

Petroleum to Pasco

----------------------------

Orca and Idaho's Chinook

Flex Spill to 125% TDG

Breach Lower Snake River Embankments

----------------------------

Social Effects

Cultural Resources

Environmental Justice

----------------------------

Conclusion

Federal Response:

The average annual value of the four lower Snake River dams exceeds the average annual equivalent costs.

UNSUPPORTABLE -- bluefish counter response:

The Fed's opening statement is unsupportable and is

diametrically opposed to the final table of Chapter 3.

Federal Response (cont):

The generation value at the four lower Snake River dams can be described by a range between the cost to replace the generation through new conventional resources or through a portfolio of zero-carbon resources. Although the costs of replacing the power with market purchases was analyzed, it is unlikely that short-term wholesale power markets could reliably replace the power for the long term. This range would put the annual value of power between $240 million and $500 million for the four dams combined.UNSUPPORTABLE -- bluefish counter response:

Yes, the value of Lower Snake River (LSR) dams "can be described" by this $240 - $500 million range, but only if generation will be replaced by what that range represents; part natural gas, and part solar with large amounts of battery storage to provide for power ramping capabilities that LSR dams might provide.Admittedly, LSR ramping capabilities -- frequently highlighted in the CRSO EIS -- could readily be replaced with combined cycle combustion turbines (CCCT) for around $240 million per year. But replacing the LSR ramping capabilities with solar plus batteries is very expensive, around $500 million per year. CCCT is the obvious Resource Replacement Portfolio for the LSR dams, but there is another option, one that the CRSO respondents have set aside as being "unlikely" in the long-term.

When running the GENESYS model to study this topic, I was quite surprised to learn that long-term export contracts frequently triggered "reliability events" that increase the model's Loss of Load Probability (LOLP). Up until then, I had incorrectly assumed that GENESYS would show reliability events only when the Northwest was short on power. I naively assumed that "long-term contracts" were all held within the Northwest (see Base Case Methodology below).

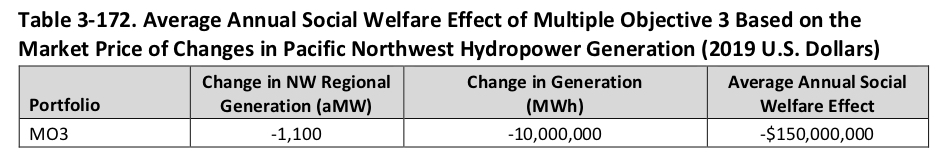

Reducing the sale of electricity outside the region (exports), along with timely market purchases when demand is likely to exceed supply, is a reasonable solution to the problem. Nascent electricity markets have become very reliablie, with short-term contracts available in day ahead, hourly and 15-minute time periods. Assuredly, cancelling and/or changing the terms on some of the ongoing electricity export contracts, would be the least expensive way to replace the foregone LSR hydropower output (Table 3-172 below and Federal Response above).

Why do CRSO respondents deem this change in contracts to be an "unlikely" solution? Is the concern of recently announced coal burning power plants, slipping into the analysis? Their reasoning is not revealed in their response to bluefish comments (above), but it seems likely that this is the case (see Coal for more on this particular topic).

Northwest Power & Conservation Council's Seventh Power Plan also finds that a "Least Cost Resource Portfolio" relies heavily upon reducing exports, currently exceeding 4,000 aMW (see "Planned Loss of Major Resource" Figure 3-14 below). The Council's result, also based on the GENESYS model, employs existing CCCT when market supply and market prices dictate. Slyly, the CRSO respondents shift our attention away from that important result, and the CRSO analysts' matching result, too.

Despite efforts to avert our attention, the facts and findings remain the same. Relying upon market purchases while reducing exports is the clear winner here, both economically and ecologically. Careful to not let that cat out of the bag, Remove Snake River Embankments should be at the core of the CRSO "Preferred Alternative". But it is not.

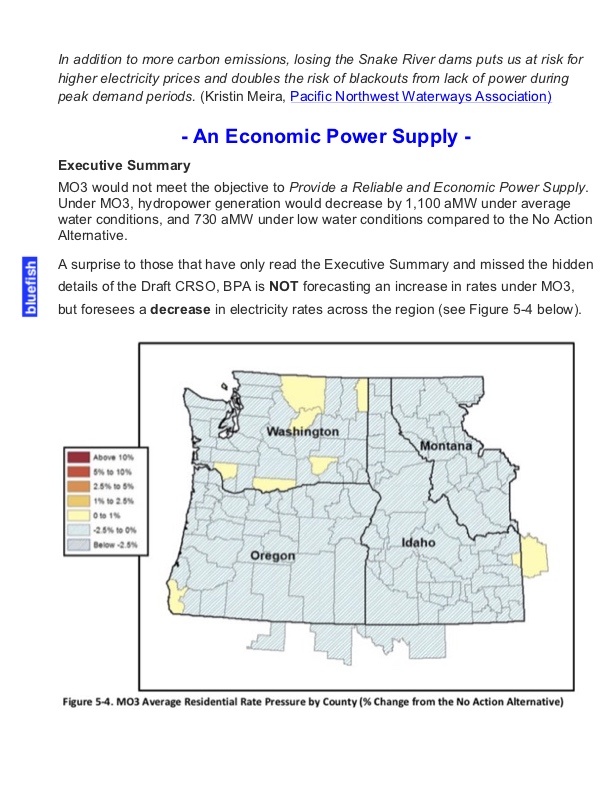

Shockingly, the NW Council has yet to provide any input to the CRSO process. None whatsoever, even though I have frequently prodded them during their monthly public comment periods. With tactics matching this corrupted CRSO process, NW Council does their best to obscure the compelling fact that Reduced Exports goes a long way in replacing the LSR hydropower output. The following graphic that reveals that finding (Figure 3-14 below) appeared only in the Draft version of their Seventh Power Plan. Similarly, CRSO Figure 5-4 (above) -- showing downward pressure on retail rates arising from Remove Snake River Embanments -- appears in the Draft version of their EIS but is missing from the Final EIS. Is honesty always the best policy?

Admittedly, "the costs of replacing the power with market purchases was analyzed" (Federal Response above) but we are asked to quickly dismiss that analysis, and without proper justification: "It is unlikely that short-term wholesale power markets could relaibly replace the power for the long term". If exports to California can be reduced now, why not long into the foreseeable future? Why is a short-term solution "unlikely" to persist into the long-term? See our Coal webpage for more on this topic.

Importantly, the NW Council's upcoming Eighth Power Plan, due for a Draft version in February 2021, will highlight the abundant solar energy coming from California in ever increasing quantity, and persisting long into the future. But as a marked deviation from their Sixth and Seventh Power Plans, the NW Council will not be considering the loss of Lower Snake River hydropower. Why do you suppose that is? The NW Power Act that established the NW Council makes it very clear that this should be in their analsysis.

Northwest Power Act -- Section 4(h)(11)(A)(i)Meanwhile, NW Council staff attempts to mollify my serious concerns, telling me "It's political. Maybe you should talk to your governor."

Exercise such responsibilities consistent with the purposes of this chapter and other applicable laws, to adequately protect, mitigate, and enhance fish and wildlife, including related spawning grounds and habitat, affected by such projects or facilities in a manner that provides equitable treatment for such fish and wildlife with the other purposes for which such system and facilities are managed and operated.

Federal Response (cont):

These numbers represent about 90 percent of the lost benefits cited in Table 3-171 of the Draft EIS because the four dams represent about 1,000 aMW of the 1,100 aMW of lost generation estimated in MO3.Off-Course -- bluefish counter response:

"90 percent" is not the correct ratio. GENESYS modeling reveals that a Remove Snake River Embankments scenario would yield a conventional Resource Replacement Portfolio of 680 MW CCCT. and Multi-Objective 3 would require 1120MW CCCT.680 MW / 1120 MW = 60%, not 90%

How is this the case? Let's back up a bit.Although I am honored that a brand new section was added to the Final EIS (see "Value of the four Lower Snake River Dam", page Chapter 3 page 3-966), verbatim to their response to the bluefish comment "An Economic Power Supply" seen here , I am chagrined by what has come from my laborious effort.

Rather than taking the sixty pages of bluefish comments to heart, the "Save Our Dam" community within the CRSO process took my comments as a challenge to address, something to be displaced, away from obstructing their intended objective. With confusing verbage, and malformed numbers in paragraph form, they protect their predetermined conclusion: Keeping the LSR dams is all important, be gone.

That is my opinion, but follow along and see if you agree.

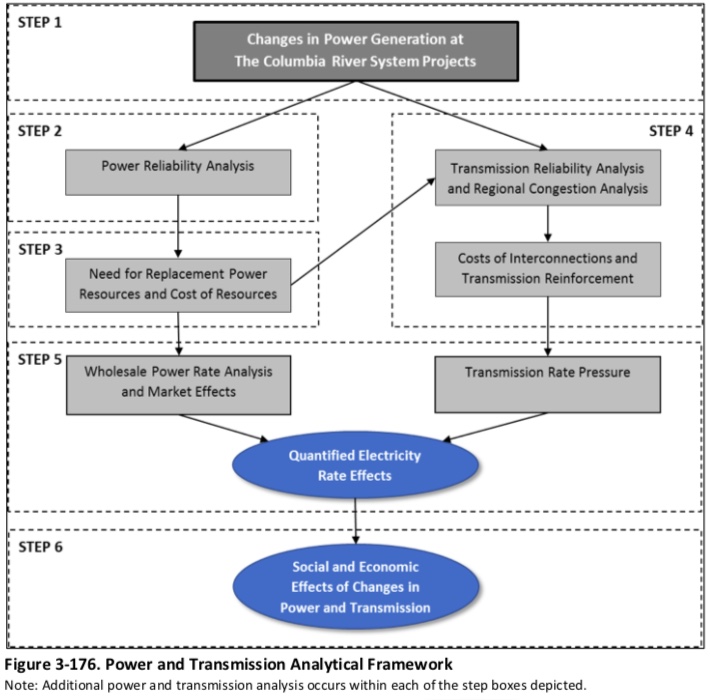

This accusation is demonstratable in the current discussion: How should these 60% or 90% ratios be derived? The key to their fallacious argument is in proposing that LSR hydropower output represents 90% of MO3 costs. Let's see why this is not the case. To a fault, the Federal Response narrative does not comply with the CRSO EIS' Analytical Framework.

Chapter 3 - Base Case Methodology (page 3-848)

The Analytical Framework (see Figure 3-17 below) provides a "high-level overview" of how the CRSO analysts estimate the economic effects of each Multiple Objective (MO). This is the proper way to proceed.

Multi-Objective 3 (MO3) is composed of three components that significantly contribute to the cost of MO3 implementation.

With the Analytical Framework, we look at Remove Snake River Embankments without the other components of MO3, then MO3 as a whole.

- Remove Snake River Embankments

- Spring Spill to 120% Total Dissolved Gas

- Reduced Summer Spill (a money maker).

- Obtain the proper input information for both MO3 and Remove Snake River Embankments.

- Run GENESYS with the inputs of both MO3 and Remove Snake River Embankments.

- By running GENESYS many times iteratively, it is found that:

- 1,120 MW combined cycle combustion turbines (CCCT) is an appropriate Resource Replacement Porftfolio for MO3.

- 680 MW of CCCT is an appropriate Resource Replacement Porftfolio for Remove Snake River Embankments.

- Notice that 680 MW / 1120 MW = 60%, not 90%.

- See how each of these results effect the Transmission system.

- See how each of these results effect the Wholesale Power Rates.

- Find the Wholesale Power Rates for both MO3 and Remove Snake River Embankments.

- Find that MO3 puts UPWARD pressure on Retail Electric Rates.

- Find that Remove Snake River Embankments places DOWNWARD pressure on Retail Electric Rates.

It really is that simple.

Following the Analytical Framework is all that is necessary.

The key to their fallacious argument, is by falsely suggesting "These numbers represent about 90% of lost benefits... because the four dams represent about 1,000 aMW of the 1,100 aMW of lost generation estimated in MO3". The 680 MW CCCT result from GENESYS is unseen. And by asking us to look at the average water year, and stepping outside of the prescribed Analytical Framework, the deception is sealed.

- Reliability events do not occur in an average water year.

- Reliability events occur during low-water years, aka. critical water years.

- Reliability events occur during critical months, not during the spring runoff.

- Reliability events are reduced in August with Reduced Summer Spill.

- Including Reduced Summer Spill on only one side of the comparison, provides for a subtle, but not insignificant deception.

At Step 3, the prescribed Analytical Framework reveals Remove Snake River Embankments as being 60% of MO3 "lost benefits".

Of no relevance to the Analytical Framework is the statement that "the four dams represent 1,000 aMW (average megawatts) of lost generation estimated in MO3". Importantly, this falacious response to bluefish comments -- now its very own section of Chapter 3 in the Final EIS -- was not within the Draft EIS, and not vetted by independent review (see External Independent Peer Review Appendix X).

680 MW / 1,120 MW = 60%, not 90%

Federal Response:

The average annual cost to operate and maintain all authorized purposes at the four lower Snake River dams is $75 million (Appendix Q, Table 5-1) and the annual-equivalent capital costs are $32 million (Appendix Q, Table 4-1). Hydropower costs funded by Bonneville represent about $50 million of the total annual operations and maintenance costs and nearly all of the annual capital costs, approximately $31 million. This puts the annual-equivalent power-specific costs at approximately $81 million a year.bluefish counter response:

In the above paragraph, CRSO respondents have correctly summed the numbers in the referenced tables. Quitely admited, is the fact that federal taxpayers are picking up $25 million of capital and $1 million of Operations and Maintenance annual expense ($75m - $50m = $25 million and $32m - $31m = $1 million).Two sentences later in the Federal Response (below) is mention of $34 million annual cost for Compensation Plan hatcheries. For consistency sake, a legitimate NEPA analysis would include this in the cost accounting. After all, the biological effects of hatchery closures, which would sometime follow Remove Snake River Embankments, is a large part of the CRSO's "uncertainty" concerning the short-term effect for Idaho's ESA-listed salmon and steelhead.

A legitimate NEPA document is self-consistent. This CRSO document is not.

Federal Response (cont):

As a result, the net benefits from hydropower for the four lower Snake River dams are between $159 million and $419 million and the benefit-cost ratios are between 3.0 and 6.2. If the $34 million per year for the Lower Snake River Compensation Plan is added to the capital and expense costs, benefits still exceed costs under each replacement power scenario. Considering these costs, the net benefits range from $125 million to $385 million and the benefit-cost ratios range from 2.1 to 4.3.In the less-likely scenario that generation could be reliably replaced with short-term wholesale market purchases and assuming that the four dams represent 90% of the $150 million in market purchases required to replace the lost generation cited in MO3 (see Table 3-170), the lower bound for net benefits would fall to $54 million and the benefit-cost ratio would fall to 1.7. With the Lower Snake River Compensation Plan included, the lower bound for annual net benefits becomes $20 million and the benefit-cost ratio becomes 1.2.

bluefish presents the proper mathematics:

Avoided costs:

$32 million ($31 million to Bonneville) annual capital cost at LSR dams;

$79 million ($50 million to Bonneville) LSR dam operations and maintenance;

$ 1 million annual cost of Columbia River Fish Mitigiation (CRFM);

$34 million annual costs at LSR Compensation Plan hatcheries;

$70 million annual savings under best case estimates of Fish & Wildlife cost reductions.

=============

$216 million of avoided costs under Remove Snake River Embankments.- $47 million amortized annual cost of Remove Snake River Embankments including appropriate mitigation.

=============

$169 million annual cost savings under Remove Snake River Embankments-$ 90 million in "Resource Resource Portfolio" (680 MW / 1,120MW of $150 million)

(Note: Table 3-312 shows $159 million as the annual cost savings. Mitigation cost estimated at $10 million (Appendix Q Annex B) was added to Fish and Wildlife cost reductions detailed in Appendix Q: "Bonneville's Fish and Wildlife Program costs are estimated as a range: from the same as under the No Action Alternative (NAA) to a 37 percent decrease, or a decrease of $105 million annually when competed to the NAA.")

=============

$ 79 million annual cost savings under Remove Snake River EmbankmentsYes, you read that correctly:

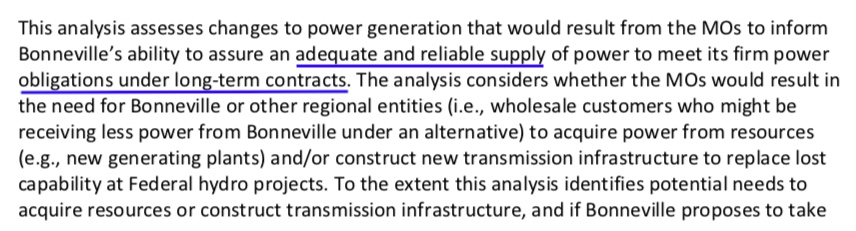

Remove Snake River Embankments saves $79 million per year, while meeting the CRSO objective of "assuring an adequate and reliable supply of power to meet firm power obligations under long-term contracts."

Federal Response:

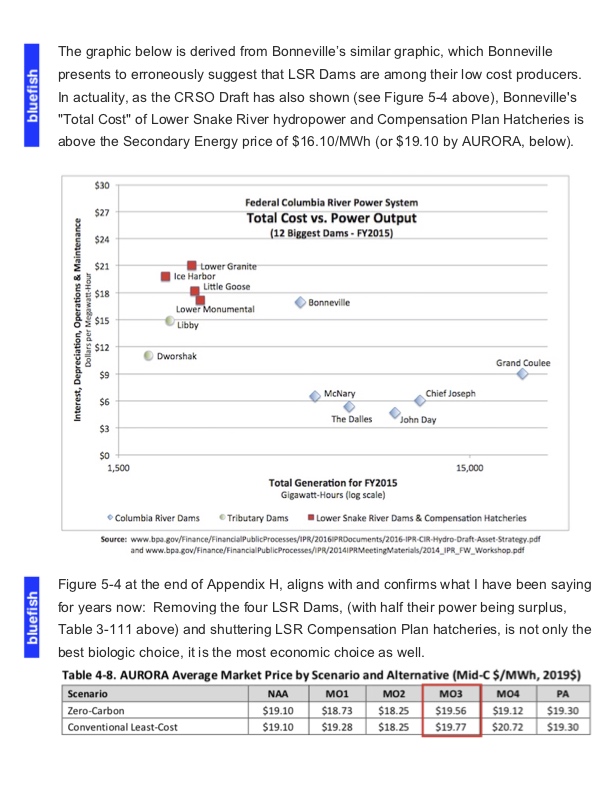

From a resource competitiveness perspective, the four lower Snake River dams are among the least costly generating resources in the Federal Columbia River Power System (FCRPS) and the planned investment strategy is expected to maintain that status.As shown in the Federal Hydropower presentation at the 2018 Integrated Program Review1, the Headwater/Lower Snake Asset Class2 is forecast to have a 50-year levelized cost of generation3 of $11.41/MWh based on the direct funded capital and expense programs outlined in that process. These costs remain competitive with volatile Mid-Columbia spot market energy prices which averaged $37/MWh in 2019 and have averaged $21/MWh in 2020.

1 The Integrated Program Review (IPR) allows interested parties to see and comment on all relevant FCRPS capital and expense spending level estimates in the same forum. The IPR occurs every two years, or just prior to each rate case, and is the public review for the costs that will be recovered through rates the following two-year rate period. Long-term forecasts for the next 50 years and major upcoming projects are also shared in this forum. This information is available here and is incorporated by reference into this EIS.

2 In the 2018 Integrated Program Review, the Headwater/Lower Snake Asset Class consisted of the four lower Snake River dams, Hungry Horse, Libby, and Dworshak dams. These projects were grouped together because they have similar cost characteristics. The Levelized Cost of Generation for the four lower Snake projects alone is slightly lower (? the table below disagrees) than that for the whole class including the headwater projects shown in the table.

3 Levelized Cost of Generation is defined as the forecasted direct costs and administrative overheads of producing power at a plant annualized over a 50-year period. This cost includes direct funded operations, maintenance, administrative and capital costs as well as Columbia River Fish Mitigation (CRFM) costs. Bonneville systemwide mitigation costs, such as its Fish and Wildlife program, are not included in this metric.MISLEADING -- bluefish counter response:

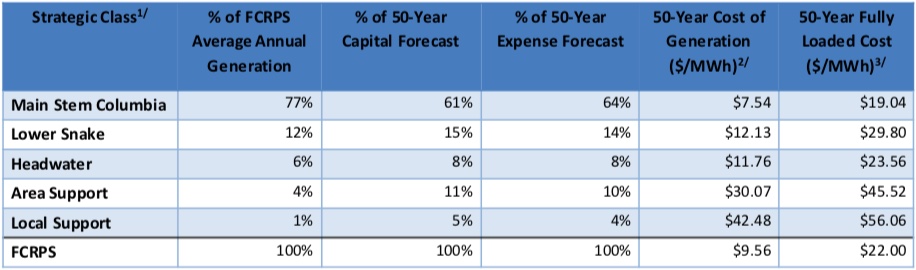

The June 2020 Integrated Program Review (IPR) Hydropower Workshop (table below) provides more recent information than the earlier IPR (table above), and the Lower Snake River (LSR) projects are considered separate from the Headwater projects: Dworshak, Libby and Hungry Horse dams.1 Headwater and Lower Snakes have been broken out into two distinct Strategic Classes for BP-22.

2 Cost of Generation represents the forecasted levelized capital and expense costs associated with producing power at the facilities for the next 50 years.

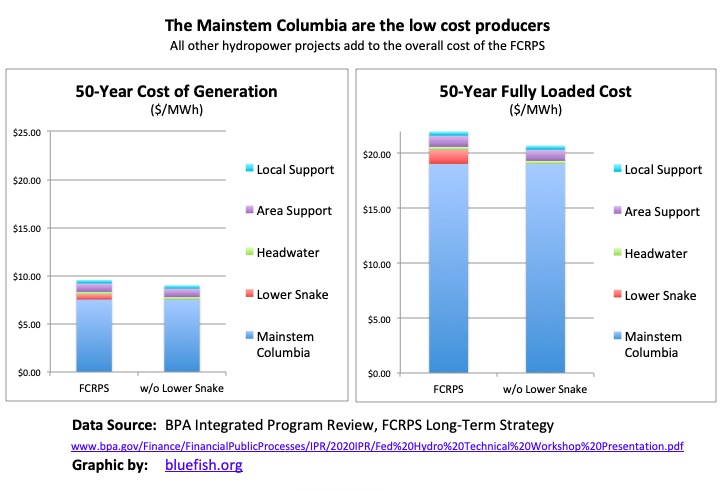

3 Fully Loaded Cost includes the Cost of Generation plus allocations for all remaining Power Services costs attributable to the FCRPS including Fish and Wildlife. The majority of these costs are system-wide costs that would still be incurred and reapportioned across other Strategic Classes if generation ceased at a certain project or projects.Clearly, the ($7.54/MWh) Mainstem Columbia projects, generating 77% of the federal hydropower, "least costly generating resources" of the federal system. All the other federal projects raise the overall price. Combined, the thirty-one hydropower projects take the overall FCRPS cost of generation to $9.56/MWh (see table above).

Misleading that it is, it may be strictly correct to say that "the four lower Snake River dams are among the least costly generating resources" but they are 60% greater in cost (($12.13 - $7.54) / $7.54) than the workhorse power providers on the Mainstem Columbia. Without these four dams, the FCRPS cost of generation would be reduced to $9.00/MWh. (See graphic below). This is simple mathematics, nothing more.

True that Remove Snake River Embankments would lead to a FCRPS that creates less hydropower, an effect discussed at length in other sections of this web series (An Adequate and Reliabile Power Supply). But the overall FCRPS is less expensive without the four Lower Snake River hydropower costs. That is the takeaway message of this web page, and it is irrefutable.

Finally, the reduced dam operating and fish and wildlife mitigation costs are discussed for MO3 in Section 3.19 and Appendix Q. For MO3, Bonneville's Fish and Wildlife (Fish and Wildlife) Program is estimated to cost $282 million annually and includes fish mitigation projects and studies across the Basin.

As stated in the CRSO Draft EIS (Appendix Q), funding decisions for Bonneville's Fish and Wildlife Program are not being made through the CRSO EIS process. Future Fish and Wildlife funding decisions would be made in consultation with the region, through Bonneville's budget-making processes and other appropriate forums and consistent with existing agreements.

Based on the inherent uncertainty of Bonneville's Fish and Wildlife Program funding requirements, with lower Snake River dam breaching, Bonneville's Fish and Wildlife costs were provided as a range for MO3, from current levels ($282 million annually) to $177 million annually, a reduction of $105 million. Bonneville currently pays USFWS approximately $34 million annually to operate fish facilities associated with the Lower Snake River Compensation Plan (LSRCP). Bonneville's funding authority for the LSRCP is directly tied to the operation of the four lower Snake River dams. In addition, approximately, $1 million annually is expended on the Columbia River Fish Mitigation (CRFM) associated with the four lower Snake River projects. Therefore, total fish and wildlife funding (or costs) for the four lower Snake River projects could range from a low of $35 million ($34 million for LSRCP plus $1 million for CRFM) to $140 million reduction ($35 million plus $105 million in Fish and Wildlife Program funding).

(Note: Only $95 million in annual cost savings is shown in Table 3-312 (below). Mitigation cost estimated at $10 million (Appendix Q Annex B) was added to estimated Fish and Wildlife cost reductions detailed in Appendix Q: "Bonneville's Fish and Wildlife Program costs are estimated as a range: from the same as under the No Action Alternative (NAA) to a 37 percent decrease, or a decrease of $105 million annually when competed to the NAA.")The range in potential reductions in salmonid mitigation costs under MO3 is captured in the Power Rate Pressure Analysis, Appendix H Section 4.1. Section 4.1.1.3 describes the Fish and Wildlife program costs and reduction in these costs under MO3. Annual equivalent capital, operations and maintenance costs would also be reduced by $107 million per year under MO3 (Table 4-4 for capital and Table 5-4 for operations and maintenance).These savings, ranging from $142 million to $212 million per year are offset by the cost to replace the power of the four lower Snake River dams ranging from $270 million to $540 million (Table 3-171). Therefore, it is not expected that breaching the four lower Snake River dams would result in lower hydropower costs for the entire Federal Columbia River Power System.

UNSUPPORTABLE -- bluefish counter response:

The cost reductions scattered around the paragraphs above are neatly organized in Chapter 3, Table 3-312. Fact is, Bonneville customers will see a substantial reduction in rates, ranging from -5.1% to -15.1%.Not to be dissuaded from their false narrative, the CRSO respondents tell us that LSR replacement costs are $270 million to $540 million. As several bluefish counter responses (above) make clear, these are overestimates and include all of MO3, not just the subset of MO3 which is Remove Snake River Embankments.

Moreover, the Northwest Power & Conservation Council's Seventh Power Plan finds a "Planned Loss of a Major non-Greenhouse Gas Emitting Resource" (very similar to Remove Snake River Embankments) could be replaced by reducing exports from the abundant 4,000 aMW surplus power currently exported. During low water years when hydropower output is diminished, forward purchases on the overnight, hourly and 15-minute power markets would be reasonable, and as the CRSO details reveal, would save $80 million annually.

Importantly, it is unsupportable for CRSO respondents to "not expect that breaching the four lower Snake River dams would result in lower hydropower costs for the entire Federal Columbia River Power System." Why?

- Table 3-312 (above) shows a cost savings to Bonneville customers of -5.1% to -15.1%;

- 50-Year Cost of Generation (graphic above) falls from $9.54/MWh to $9.00/MWh;

- 50-Year Fully Load Cost (graphic above) falls from $22.00/MWh to $20.70/MWh.

- On low-water years, Bonneville could purchase forward contracts for its firm power customers.

- Substantial cost savings arise by not killing ten to twenty million Idaho salmon and steelhead, annually.